Unexpected expenses can strike at any time, whether it’s a medical emergency, car repair, or job loss. Having an emergency fund acts as your financial safety net, ensuring you stay afloat when life throws curveballs. In this guide, we’ll explore why Building an Emergency Fund is essential and how you can start saving consistently without stress.

Why Do You Need an Emergency Fund?

An emergency fund isn’t just a luxury—it’s a necessity. Here’s why:

- Protects Against Financial Setbacks: Covers unforeseen costs like medical bills or home repairs.

- Reduces Stress: Knowing you’re prepared for emergencies gives you peace of mind.

- Prevents Debt: Avoid high-interest loans or credit card debt during tough times.

How Much Should You Save?

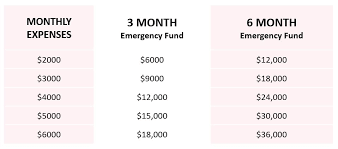

The ideal size of your emergency fund depends on your lifestyle and expenses. Experts recommend:

- 3-6 Months of Living Expenses: Covers essentials like rent, utilities, food, and insurance.

- Start Small, Grow Gradually: Even $500 can make a difference in emergencies.

Practical Steps for Building an Emergency Fund

- Set a Savings Goal: Determine your target amount based on monthly expenses.

- Create a Budget: Use tools like budgeting apps or spreadsheets to identify areas to cut back.

Try our Budget Calculator to optimize your savings. - Automate Savings: Schedule automatic transfers to a dedicated savings account.

- Reduce Non-Essential Spending: Skip unnecessary purchases and redirect funds to your emergency savings.

Where Should You Keep Your Emergency Fund?

- High-Yield Savings Accounts: Earn interest while keeping your money accessible.

- Separate Bank Account: Prevents accidental spending.

Tips for Consistent Savings

- Save Windfalls: Redirect bonuses, tax refunds, or gifts into your fund.

- Track Progress: Regularly review your savings to stay motivated.

- Reassess Periodically: Adjust your fund size based on changes in income or expenses.

Real-Life Example

Sarah, a freelance designer, started saving just $100 per month. Within a year, she built a $1,200 emergency fund, which covered unexpected medical expenses and avoided credit card debt.

Must read our article about Personal Finance Management: 7 Step Guide To Fredom.

Secure Your Financial Future Today

An emergency fund isn’t just about money—it’s about peace of mind and resilience. Start small, stay consistent, and watch your financial safety net grow.