Mastering Personal Finance: Transform Your Money Mindset

Are you tired of living paycheck to paycheck or feeling lost when it comes to managing your money? Let me tell you this: Personal Finance Management is closer than you think. With the right strategies, you can take control of your finances and start building the life you’ve always dreamed of.

Whether you’re here to learn budgeting tips, discover the best financial tools, or explore investment strategies, this guide will equip you with everything you need. Ready to dive in? Let’s get started!

Step 1: Personal Finance Management Simplified: Setting Financial Goals That Work

You can’t manage what you don’t measure.

Start by defining your financial goals. Ask yourself:

- Do you want to build an emergency fund?

- Are you aiming to clear debt using proven debt repayment strategies?

- Do you want to save for a big purchase like a home or car?

Pro Tip: Write down your goals and break them into short-term, medium-term, and long-term targets. This clarity is your first step toward success.

Related Resource: Check out our guide on goal-setting for financial success on Wisara.

Step 2: Personal Finance Management Starts with Budgeting Smarter

Here’s the truth: a budget is your best financial weapon.

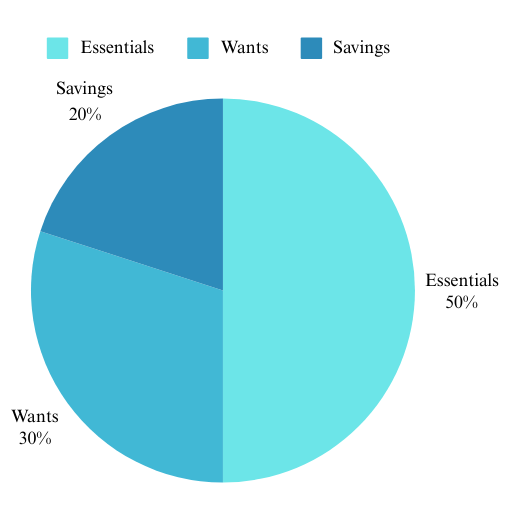

The 50/30/20 rule is a simple, effective strategy:

- 50% for essentials (rent, groceries, bills).

- 30% for wants (dining out, entertainment).

- 20% for savings and debt repayment.

Track every expense for at least a month using free tools like Mint or YNAB. You’ll be shocked at how much you can cut back when you see where your money goes.

Power Tip: Automate your savings so you “pay yourself first.”

Step 3:Conquering Debt: Your Path to Mastering Personal Finance

Debt is the silent killer of financial dreams.

The two most effective methods to eliminate debt are:

- Debt Snowball Method: Pay off the smallest debts first to gain momentum.

- Debt Avalanche Method: Focus on high-interest debts first to save money.

Choose the method that keeps you motivated, and make a commitment to never take on unnecessary debt again.

Quick Win: Negotiate lower interest rates with your lenders—it works more often than you think!

Related Resource: Discover our expert guide on debt management strategies.

Step 4: Mastering Personal Finance: Why an Emergency Fund is Non-Negotiable

Life is unpredictable, and that’s where an emergency fund steps in. Aim to save 3-6 months’ worth of living expenses in a high-yield savings account.

Start small if you need to. Saving even $10 a week adds up over time. Remember, this fund is your insurance against financial disaster.

Step 5: Invest Like a Boss

Saving is good, but investing is better.

Here’s why: compound interest grows your money exponentially.

- Start with index funds or ETFs for low-risk, diversified growth.

- Use apps like Robinhood or Webull to get started with as little as $5.

- Max out your retirement accounts (401(k) or IRA).

Golden Rule: Start early and stay consistent. Time in the market beats timing the market every time.

Step 6: Monitor and Adjust Regularly

Your financial situation isn’t static—neither should your plan be.

Set a monthly “money date” with yourself to review:

- Your spending habits.

- Progress toward your goals.

- Adjustments needed to your budget or investments.

Pro Tip: Use tools like Personal Capital to get a bird’s-eye view of your finances in one place.

Related Resource: Read more about financial tracking tools on Wisara.

Step 7: Educate Yourself Continuously

The more you know, the more you grow.

Follow trusted personal finance blogs, podcasts, and YouTube channel Nate O’Brien. Read books like “The Total Money Makeover” by Dave Ramsey or “Rich Dad Poor Dad” by Robert Kiyosaki.

Make learning about money management a lifelong habit—it pays dividends.

Why You Should Start Right Now

Waiting won’t make things better—action will. Whether you’re drowning in debt or looking to optimize your investments, there’s no better time to start than today.

Every small step you take today moves you closer to financial independence.

The Takeaway: Your Future Awaits

Imagine a life where you’re not stressed about money, where you have the freedom to make choices based on passion, not financial need. That life starts here, with the steps you’ve just learned.

This isn’t just another blog post; it’s your blueprint for success. Bookmark this page, revisit it often, and start applying these strategies one by one.

Are you ready to take control? Then don’t just close this tab—make it your first step toward financial freedom. Explore more on Wisara for deeper insights, tools, and strategies to transform your money mindset.

Come back soon! Every week, we share actionable tips on budgeting, saving, and investing to help you thrive financially. Don’t miss out—your future self will thank you.

Pingback: Building an Emergency Fund: The Ultimate Guide to - wisara